Synthetic Diamond Market Analysis and Emerging Industry Opportunities

Table of Contents

1. Market Size and Growth Trends

In recent years, the global synthetic diamond market has entered a phase of multidimensional transformation. Breakthroughs in manufacturing processes, expanding industrial applications, the restructuring of jewelry consumption patterns, and the intensifying impact of trade policies have collectively pushed the industry into a period of steady growth combined with structural adjustment.

According to the latest report from Research and Markets, the global synthetic diamond market was valued at USD 19.21 billion in 2024 and is expected to reach approximately USD 20.3 billion in 2025, reflecting a CAGR of 5.7%. By 2029, the market is projected to reach around USD 27.25 billion.

Data from FMI also indicates that the market is valued at about USD 27.2 billion in 2025, with the potential to reach USD 44.8 billion by 2035.

2. Growth Drivers and Key Application Sectors

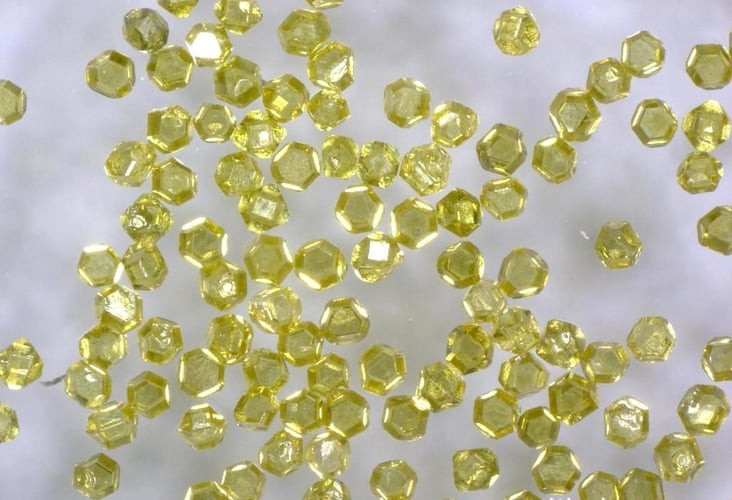

On the industrial front, synthetic diamonds—known for their exceptional hardness, thermal conductivity, and wear resistance—are increasingly used in cutting tools, drilling equipment, grinding products, and precision machining processes.

Applications in electronics, semiconductors, and advanced technology equipment continue to expand. Sectors such as lasers, X-ray systems, quantum computing, and thermal management components are driving demand for high-performance materials, resulting in higher consumption of synthetic diamonds.

In the jewelry market, lab-grown diamonds, widely viewed as a lower-cost alternative to natural diamonds, are gaining consumer acceptance, contributing additional demand momentum.

Meanwhile, advances in HPHT and CVD manufacturing processes continue to reduce costs and improve product quality, accelerating the commercial adoption of synthetic diamonds.

3. Key Challenges and Emerging Opportunities

The jewelry segment, although growing rapidly, faces downward pricing pressure and oversupply risks. In October 2025, the World Diamond Council noted that lab-grown diamonds had “lost some of their luster” as soaring production led to steep wholesale price drops and wavering consumer confidence. The expansion of e-commerce channels and customization services is also reshaping traditional jewelry retail models. In this environment, branding, differentiation, and design are becoming decisive competitive factors.

In contrast, industrial applications—cutting, grinding, drilling, optics, and electronics—are unlocking new substitution potential. Rising demand from EV manufacturing, semiconductor fabrication, 5G/6G technologies, and quantum computing is fueling the use of synthetic diamonds in grinding tools, cutting heads, thermal modules, and optical substrates. China maintains a strong competitive edge thanks to its scale and cost advantages.

However, trade frictions and new tariff policies have become unavoidable challenges. For instance, following U.S. tariff increases, India’s diamond exports to the U.S. dropped sharply in July 2025, despite some exporters shipping early to avoid tariff changes. Similar shifts in U.S.–India and EU–India tariff structures are creating disruptions across the global supply chain. To mitigate these risks, companies are increasingly exploring multi-regional production, diversified distribution channels, alternative materials, and value-added services.

In this context, service platforms and supply-chain hubs in neutral or strategic markets are gaining importance. For example, Abrasivestocks, with its warehouse network in Australia, supports Chinese manufacturers entering the Australian market by providing local storage, logistics, and channel development assistance. At the same time, it helps Australian hardware, tools, and advanced-material companies access the Chinese market by facilitating faster sampling, cross-market product adaptation, and industry matchmaking. This form of two-way support helps companies cushion policy risks and accelerate their international reach.

4. How Companies Can Capture New Opportunities

1) Accelerate technological and manufacturing upgrades

Focusing on improving process efficiency, reducing energy use, optimizing production lines, and advancing toward high-performance applications—such as quantum technologies, optical components, and aerospace materials.

2) Shift toward branding and service-driven models

Transition from mass OEM production to brand-led manufacturing + value-added solutions.

In jewelry: emphasize design, customization, and differentiated aesthetics.

In industrial sectors: highlight system solutions, tool packages, and long-term consumable support.

3) Strengthen global deployment and compliance capacity

Build diversified production and distribution networks to withstand policy fluctuations. Prioritize sustainability strategies including low-carbon manufacturing, environmental compliance, and circular materials.

In this area, partnerships with supply-chain service providers—such as Abrasivestocks’ Australia–China two-way logistics and market-entry support—can help firms localize more efficiently and navigate regulatory requirements in both markets.

4) Product and application differentiation

In grinding tool manufacturing, synthetic diamonds can be used in tool sharpening, reinforced grinding wheels, and cutting-head production, enabling higher-value components for garden tools, hardware equipment, and precision machining tools.

Reference sources: :GlobeNewswire、researchandmarkets、blog.tbrc.info、GlobeNewswire