Is the Indian Grinding Market Worth Entering?This Article May Give You the Answer

Table of Contents

I. Market Overview

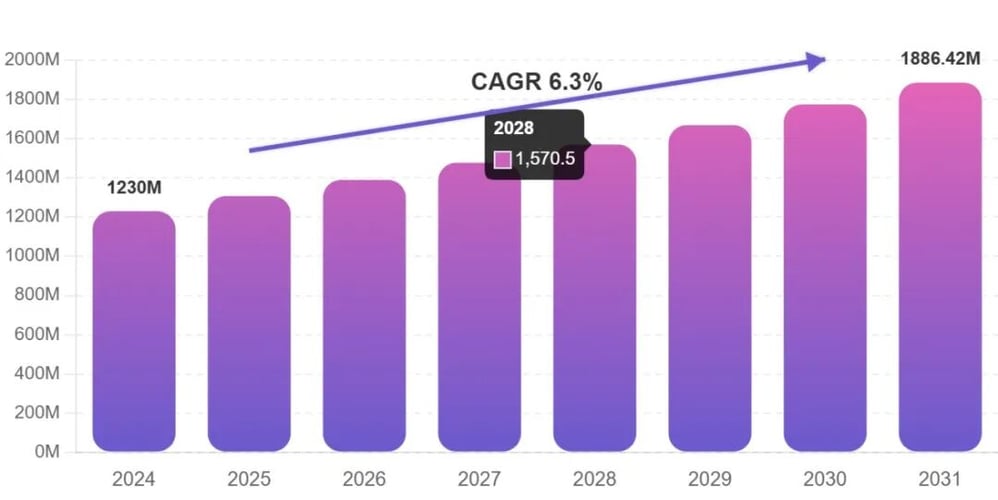

Over the past decade, the Indian industrial abrasives and grinding tools market has gradually entered a phase of steady growth. In 2024, the market size reached approximately USD 1.23 billion and is projected to expand at a compound annual growth rate (CAGR) of around 6.3% from 2025 to 2032, reaching nearly USD 1.78 billion by 2032.

Driven by the expansion of manufacturing capacity, rising automotive output, accelerated infrastructure development, and the growing share of precision machining, the application scenarios for abrasives continue to broaden, generating sustained and structurally diversified demand.

The Indian abrasives market mainly covers bonded abrasives, coated abrasives, and superabrasives such as diamond and cubic boron nitride (CBN). These products are widely used in metalworking, automotive components, construction, machinery manufacturing, stone processing, and aerospace. As India’s manufacturing sector upgrades and materials move toward higher value-added applications, grinding efficiency, wear life, and machining accuracy have become core factors in purchasing decisions.

Indian Industrial Abrasives and Grinding Tools Market

II. Key Demand Drivers

1. Manufacturing Expansion Sustains Stable Demand

India’s manufacturing sector has maintained a long-term growth rate of 4%–6%, supported by the ongoing “Make in India” initiative, which continues to stimulate equipment investment, foreign direct investment, and supply-chain localization. Capacity expansion in metal processing, electrical equipment, heavy machinery, and electronics manufacturing has kept demand for grinding, cutting, and surface finishing robust. Demand for bonded abrasives has maintained a growth rate of 8%–10% in recent years.

2. Construction and Infrastructure Projects Drive Rapid Growth of Coated Abrasives

India’s construction industry is valued at nearly USD 600 billion. National infrastructure programs covering highways, ports, industrial parks, and rail transit are expected to continue over the next decade. Extensive processes such as metal structure fabrication, concrete surface finishing, assembly operations, and stone cutting have significantly increased the consumption of coated abrasives. Between 2019 and 2024, growth in coated abrasives demand within the construction sector notably exceeded the industry average.

3. Automotive Industry Continues to Upgrade Demand for Precision Grinding

As the world’s fourth-largest automotive producer, India maintains an annual output of over 4.5 million vehicles and is rapidly expanding into new energy vehicles (NEVs). Precision grinding is essential in the manufacturing of engines, transmissions, braking systems, and high-precision components. Demand for high-performance abrasives, particularly ceramic abrasives and superabrasives, continues to rise, with increasing penetration across the automotive supply chain. The adoption of lightweight and composite materials further accelerates abrasive upgrading.

4. Renewable Energy Equipment Manufacturing Creates New Growth Opportunities

India plans to achieve 500 GW of installed renewable energy capacity by 2030, covering wind and solar power. High-performance abrasives are increasingly required for wind turbine main shafts, gearboxes, blade molds, and photovoltaic silicon wafer cutting. This segment is expected to maintain a high growth rate of 12%–15% over the next several years.

III. Market Constraints

1. Raw Material Price Volatility Compresses Profit Margins

Key raw materials such as aluminum oxide, silicon carbide, and phenolic resins are highly sensitive to energy costs, global supply-demand dynamics, and currency fluctuations, with annual price swings often exceeding 15%–20%. Small and medium-sized enterprises face significant pressure in procurement, inventory management, and cost control, resulting in compressed industry-wide margins.

2. Stricter Environmental Regulations Increase Production Costs

India has introduced increasingly stringent regulations on dust emissions, volatile organic compounds (VOCs), and solid waste management, forcing manufacturers to invest more in equipment upgrades and process improvements. For some producers, environmental compliance-related capital expenditure accounts for 15%–25% of annual revenue, impacting capacity utilization and cost structures in the short term.

3. High-End Market Remains Dominated by International Brands

Global abrasive leaders retain clear advantages in high-performance grinding wheels, ceramic abrasives, and superabrasives. Although Indian manufacturers are growing rapidly, gaps remain in raw material formulation, product consistency, automated manufacturing, and R&D capabilities—particularly in high-end precision machining applications.

4. Alternative Processes Exert Pressure on Certain Grinding Applications

With the maturation of laser cutting, waterjet cutting, and electrochemical machining, traditional abrasives face substitution in applications such as thin-sheet cutting and fine slotting. This trend compels abrasive manufacturers to develop multi-functional and higher value-added products to maintain competitiveness.

IV. Market Structure and Competitive Landscape

India’s abrasives industry exhibits a fragmented competitive structure, with a few core players holding clear advantages. Carborundum Universal Limited and Grindwell Norton Ltd lead the market, possessing strong technical capabilities in bonded and ceramic abrasives. Wendt India Ltd specializes in diamond and CBN superabrasives, maintaining continuous R&D investment and serving aerospace, medical devices, and high-precision mold manufacturing.

Mid-sized companies such as Sterling, Orient, and Sak are moving into higher-end segments through capacity expansion and equipment upgrades, enhancing the resilience of the domestic supply chain.

Overall, the industry is following a dual-track development pattern, with leading players advancing into high-end markets while local manufacturers accelerate capacity expansion.

V. Major Market Trends

1. Rapid Increase in High-End Abrasive Penetration

The share of ceramic abrasives, CBN, and diamond tools rose from 18% in 2018 to 27% in 2024, indicating a clear shift from low-cost traditional abrasives toward higher efficiency and longer service life.

2. Growing Focus on Sustainable and Environmentally Friendly Products

Driven by regulatory pressure and customer demand, development of water-based coated abrasives, low-dust grinding products, eco-friendly resin systems, and recyclable backings has accelerated significantly. Green abrasives are growing at twice the industry’s average rate.

3. Automation and Intelligent Manufacturing Raise Performance Requirements

The widespread adoption of automated production lines, robotic grinding and polishing stations, and CNC grinding equipment requires abrasives with higher consistency, lower defect rates, and more stable cutting performance—further expanding demand for high-end products.

VI. Future Growth Outlook

Considering policy support, industrial upgrading, manufacturing investment trends, and global supply-chain shifts, the Indian industrial abrasives market is expected to maintain sustainable growth over the next seven years. As domestic manufacturers enhance technical capabilities, strengthen supply chains, and increase penetration of high-end products, the market will gradually transition from a cost-driven model to a performance- and innovation-driven model.

In the long term, the core competitiveness of abrasive and grinding tool manufacturers will focus on three areas:

1.Mastery of high-performance abrasive material technologies, including ceramic, superabrasive, and composite grinding tools;

2.Enhancement of automation and intelligent manufacturing to ensure product consistency;

3.Deepened application-oriented R&D to meet the machining needs of automotive electrification, aerospace, precision engineering, and renewable energy equipment.

4.The Indian abrasives and grinding market is entering a critical phase characterized by simultaneous volume growth and quality upgrading. High-end demand is emerging rapidly, while local capacity still requires reinforcement, and import dependence is unlikely to disappear in the short term. This structural window presents a rare opportunity for Chinese abrasive, grinding tool, and grinding equipment manufacturers to enter the Indian market.

As a result, growing industry attention is now focused on IPTEX-GRINDEX 2026 – the Pune Surface Grinding & Finishing Expo & the 9th India Gear & Bearing Exhibition, one of India’s most influential exhibitions dedicated to precision machining and grinding technologies.

Whether in bonded abrasives, coated abrasives, superabrasives, or precision grinding equipment, exhibitors can find direct pathways to connect with genuine end-user demand in India.

See you in Pune in 2026.

Exhibition Information

Exhibition Name:

Pune Surface Grinding & Finishing Expo 2026 &

9th India Gear & Bearing Exhibition (IPTEX-GRINDEX 2026)

Venue: Auto Cluster, Pune, India

Dates: February 26–28, 2026

Contact:

Bai Ning: +86 185 9580 5333

Yu Ning: +86 191 3819 2120

Zhang Qi: +86 191 3819 2121